We want to let you know about some changes directed by the Northwest Multiple Listing Service (NWMLS) regarding how those selling office commissions are determined. The intention is that sellers will have a greater degree of choice on what commission, if any, they offer to the brokerage representing the buyer. These changes will have implications for sellers and buyers in real estate transactions as well as Appraisers and Lenders.

At the time of writing this article, the changes are fresh. The full implications are not yet quite visible. We anticipate additional changes to come and we will keep you apprised as to what those changes are and what that may mean to you people buying or selling real estate. This article is to inform you of what we see so far and how you as a buyer or seller in a transaction can best position yourself in a transaction.

Previously, the expense of both the listing and selling side of the commission was deducted from the sales price of the property. Now that may no longer be the case. Not all sellers will offer a commission. For this reason, Buyer Agency Agreements will become more prevalent. These are agreements where the buyer ensures their broker will receive a certain commission regardless whether there is one offered by the seller.

Let’s consider the 2 extreme versions of the argument. Most brokerages do not offer more than 3% commission, so I will use that in this equation and I will use 0%, no commission paid to illustrate the difference.

Changes for Sellers

Sellers will have greater options on selecting what commission they offer to the Buyer’s representative if any. The intention is to save the seller money. However, will it save the seller money if they do not pay the selling office commission? A little. However, that saving does come at a cost and makes your listing less competitive. Let me try to demonstrate to you why.

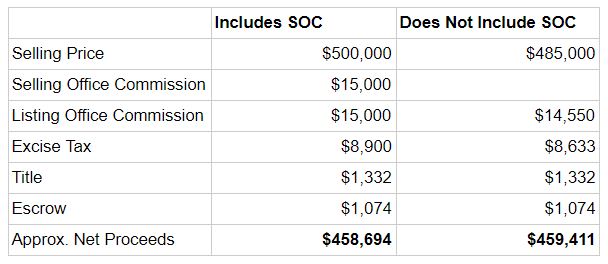

The following table shows an approximate net proceeds in an apple to apple comparison:

(Note that for the total sales price to remain equal to the buyer, the equal sales price for the seller is $485K, not $500K in this case.)

Changes for Buyers

For the buyer(s), this will have the following implications.

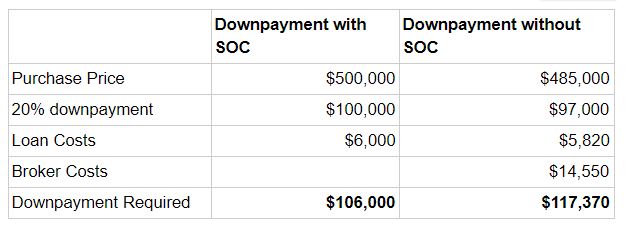

As you can see, if the seller pays the commission, the out of pocket cost for the buyer on a 20% down mortgage is $106K vs. $117K+ if the buyer has to pay their broker directly. This may not seem like a huge change, but in our experience it is and not one that often works in the sellers’ favor. Some buyers that could qualify for your property could no longer qualify for a property if the seller chooses not to pay their broker’s commission.

Impact on a Listing

When it becomes more difficult for a buyer to qualify for a mortgage, that listing is now less competitive than when a commission is offered. This can lead to increased listing time and a lower sales price.

Changes for Lenders

To accommodate this change, a few lenders allow their clients to wrap the commission into the loan. However, thus far the appraisal does need to match or exceed the sales price plus the commission.

Confusion around Appraisals

At the moment, the appraised value and sold value of a home is assumed to include the Selling Office Commission. In the future however, that will not be clear. This can lead to lower and less accurate appraisals. We anticipate additional changes coming to keep appraisals accurate.

Our Recommendation to Sellers

Each property and location is unique. A listing strategy should be carefully crafted between a seller and their listing broker to provide the best possible intended outcome. If you are considering listing your property, we recommend meeting with a real estate broker who can walk you through all your options to help you decide what strategy is likely to work best for your property.

Leave a Reply