![]()

My first real estate transaction as a broker was in mid-2016, when I represented a Florida-based investor who was interested in finding a condominium in downtown Seattle. The rapport I built with him was bolstered by market knowledge and later by negotiation skills—and thank goodness for that, because what I didn’t know would have had me dismissed by most. I didn’t speak the language of the investor, nor did I possess the ability to perform a legitimate financial analysis. Glaringly obvious and a little bit embarrassing, I vowed to change it.

Then life happened, as it often does, and the desire to get smart about investing was forced to compete with other desires and time challenges, and so it landed squarely on the back burner. That first transaction experience stuck with me, however, and after two years I resolved to address the deficiency once and for all.

Long story short, this endeavor led me to attain the Certified Real Estate Analyst (CREA) designation, establishing myself as an investor-friendly Realtor. The CREA credential represents one’s ability to speak the language, to deftly manipulate a financial calculator, and—most importantly—to perform the complex computations that distill a range of incredibly useful numbers. (Note that the ability to perform the computations manually is key to knowing what the numbers represent; there are no shortcuts.)

It would be impossible for me to teach these computational skills in the form of a blog. There are lengthy classes for that! In fact, ask me and I’ll help point you to one. What I hope to impart here are a few useful concepts for investors and the people that work with them.

Investors don’t buy real estate, they buy what they think it will do for them. With that in mind, here are a few observations:

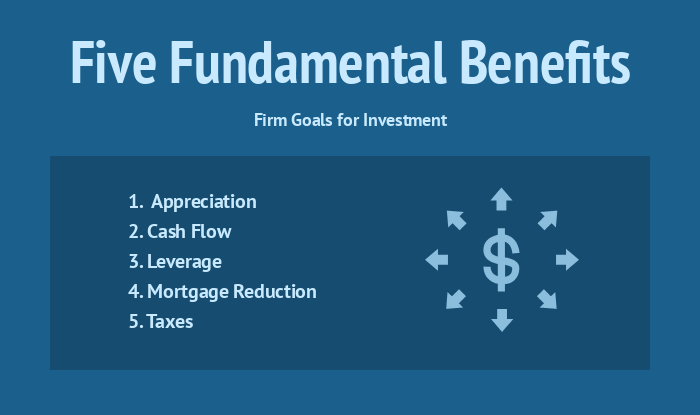

1. Every investor should measure value against expectations, expressed by firm goals tied to one or more of the five fundamental benefits:

2. Capturing and quantifying a greater number of the benefits necessarily requires a greater quantity of data and complexity of computation.

3. If you tell an investor what to buy, you must be able to tell them why, which requires a variety of metrics. The “why or why not” is derived by computation in order to asses whether it meets his or her expectations.

4. When listing an investor’s property, you must help buyers (who are likely investors themselves) answer those very same questions.

In summary, it is good practice to question the data being presented to you. Much of the cap-rate data in the Northwest Multiple Listing Service (NWMLS) is either consciously or unconsciously misrepresented. Request an APOD and a Schedule E, and run the computations yourself. Be advised that basic cap-rate, the holy grail of analysis per the NWMLS and most wannabe investors, only captures two of the five benefits of real estate investment. Advanced cap-rate, for instance, accommodates the mortgage constant and weighted cost of capital, which makes it a much safer figure with which to make decisions. Safer still is to run all the way through T-Account and IRR. These computations are the only ones to account for all five benefits of real estate investing, including potential tax advantages.

It’s critical to know what you don’t know. And if you don’t know enough, then it’s best to partner with someone who does—I’m here to help.

– Written by Chris Kallin

Leave a Reply